SEIS stands for Service Exports for India Scheme, introduced by the Directorate General of Foreign Trade (DGFT). Introduced under the five-year Foreign Trade Policy 2015-20, the policy aims to promote export services from India by providing duty scrip credit for eligible exporters.

Duty Scrips are certificates issued by the government and can be used to pay various kinds of taxes and duties, associated with exporting services in India, and will be fully transferable meaning they can be sold to other importers and exporters.

This is a strategy used by the Indian government to boost exports. The focus of this scheme is to support both the manufacturing and services sector, with a special emphasis on improving the ‘ease of doing business. It covers various services such as professional, travel-related, construction, etc.

Let us understand more about SEIS, the eligibility criteria, the application process, etc.

Eligibility Criteria

This scheme is open to service providers based in India, engaged in the export of services. Service providers of notified services who have minimum net free foreign exchange earnings are eligible to claim the benefits under this scheme. The list of eligible services is specified by the Directorate General of Foreign Trade (DGFT). Here are the eligibility criteria:

- Be a service provider based in India.

- Have earned a minimum net free foreign exchange in the previous financial year ($10,000 for individuals and $15,000 for others).

- The service provider must have an active Import Export Code (IEC) issued by the DGFT.

- The services exported must be listed under the SEIS eligible services categories.

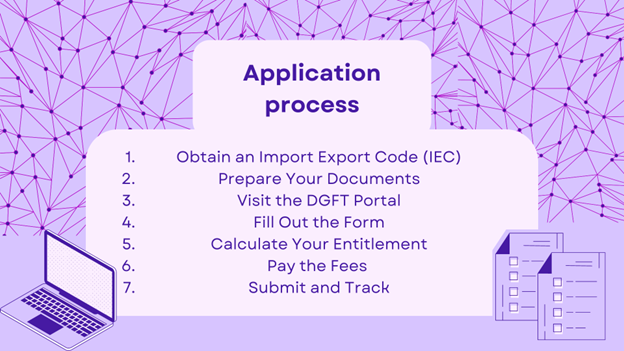

Application Process

Service providers need to file an application with the DGFT to claim the SEIS benefits. The application requires submission of specific documents such as the Import Export Code (IEC), Foreign Inward Remittance Certificate (FIRC), and other financial statements. Here is a step-to –step guide for the application process: –

- Get an IEC: Make sure your business has an active Import Export Code (IEC) from the DGFT.

- Prepare Your Documents: Gather all necessary paperwork, like your export turnover statement, Foreign Inward Remittance Certificate (FIRC), service tax returns, annual financial statements, and a declaration that you haven’t claimed benefits under any other scheme for the same exports.

- Visit the DGFT Portal: Register or log in to the DGFT website using your IEC and other credentials.

- Fill Out the Form: Complete the application form ANF 3B and upload your documents.

- Calculate Your Entitlement: Determine your SEIS entitlement based on your net foreign exchange earnings. Check the SEIS notification for the percentage applicable to your service category.

- Pay the Fees: Pay the application fee online and keep a copy of the payment receipt.

- Submit and Track: Submit your application through the DGFT portal and track its status online.

Benefits of SEIS

SEIS provides several benefits to promote export of services in India. The major benefits under SEIS are:-

- Duty Credit Scrips: These can be used to pay various taxes and duties, typically ranging from 3% to 5% of your net foreign exchange earnings.

- Cost Savings: By using these scrips to offset customs duties, you can reduce the cost of importing goods, making your operations more cost-effective.

- Global Opportunities: SEIS supports you in exploring international markets, helping you earn more foreign exchange.

Rewards rates and Services

The Services Exports from India Scheme (SEIS) offers duty credit scrips to service providers based on a percentage of their net foreign exchange earnings. These percentages, known as SEIS rates, vary depending on the type of service provided. These SEIS rates can also differ from one category to another and are subject to change based on government policies among other factors. Service providers should check the latest Foreign Trade Policy and DGFT notifications for current rates applicable to their services.

SEIS rewards, or Duty credit scrips are designed to incentivize the export of services from India. The key aspects of SEIS rewards are:

- Net Foreign Exchange Earnings:

Rewards are based on net foreign exchange earnings, calculated as the total foreign exchange earned from service exports minus the total foreign exchange spent on importing services.

- Percentage-Based Rewards: The rewards are given as a percentage of the net foreign exchange earnings. This percentage varies by service category and is specified in the Foreign Trade Policy.

These duty credit scrips can be used for the payment of basic custom duties, pay excise duties on domestically sourced goods and service tax on procurement of services and freely transferable with an 18-month validity from the date of issuance.

Summing up

SEIS is a fantastic initiative by the Indian government to support businesses in exporting services. While it offers substantial benefits, managing international payments can still be costly. To save on bank and forex charges, consider using services like BRISKPE for seamless and cost-effective cross-border payments. By understanding and utilizing SEIS, you can significantly enhance your business’s global reach and financial health.